Introduction

The U.S. is one of the most appealing markets for affiliates today, due to the booming market for legal Internet gambling and its large paying audience.

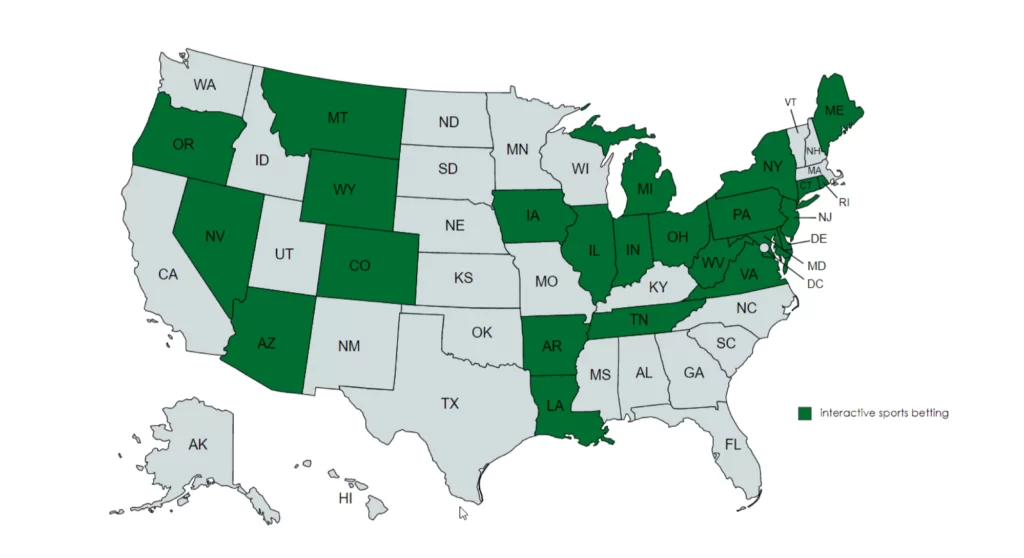

Since 2017, sports betting has become a licensed activity in more than 32 states (four more states are in the process of passing legislation). ⅓ of the nation’s population lives in states where online betting is legal.

States where sports betting is legal and requires a license (for operators) Actual as of 11.07.2022

Nevertheless, gambling laws have their peculiarities and differences depending on the particular state, and they can be divided into two categories:

- states where an affiliate’s activities are legal, the license is not required;

- states where such activities require a license.

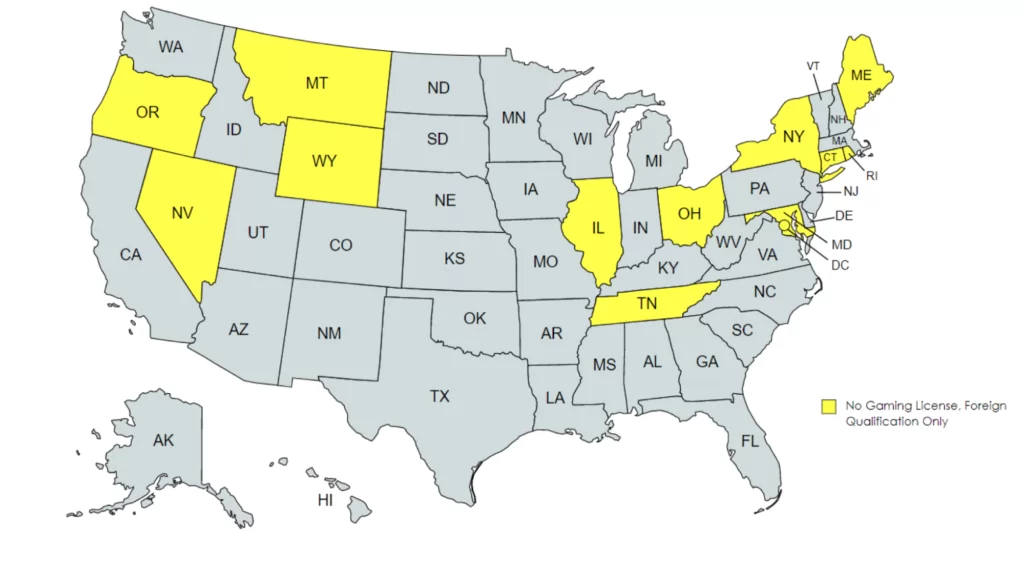

States without a license requirement

You do not need a local license to operate in the states listed above. To provide services to operators in the states above, you must obtain Foreign Qualification in each individual state and hire a Registered Agent in each individual state.

The process of hiring a registered agent is very simple, you need to sign a contract with a special company in the state (this company is a registered agent), which will provide an address for receiving official correspondence in the state. The cost of these services varies and on average costs 125 USD per year for each state.

What is Foreign Qualification?

Foreign Qualification is the registration of your company with the Secretary of State’s office in another state so that your company can legally do business in that state without having to register a new legal entity in that state.

The process consists of filing an application and paying the state fee.

Once the Registered Agent is contracted and Foreign Qualification is paid, the affiliate can begin working with the state’s operators.

Please pay attention! The process must be done in each state where the company plans to operate.

On average, the process takes 2 weeks per state and can be started simultaneously for all states of interest. The process can be done completely remotely.

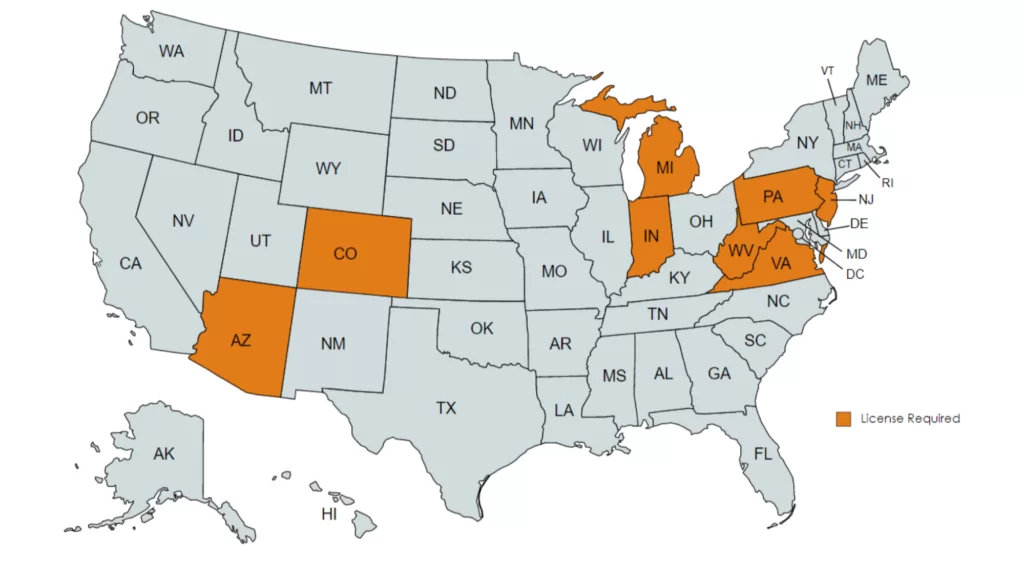

States with a license requirement

Currently, a number of states, in addition to licensing for operators, have introduced a licensing regime for suppliers (includes affiliates).

The licensing process differs from state to state. Regardless of the state, it is still necessary to hire a registered agent and obtain Foreign Qualification in the state where the affiliate wants to be licensed.

Timeline for licensing is 2 weeks to 3 months, depending on state.

The process is quite simple and consists of filling out a form and collecting documents. In some states (e.g., Indiana), it is also necessary to submit fingerprints.

General list of requirements:

- Contract or partnership agreement with a licensed operator in the state;

- Corporate documents of the applicant’s company;

- Passports, proofs of address of director and shareholders of the company;

- Company ownership structure;

- Certificates of absence of criminal record;

- EIN number.

A bank account is optional.

The regulator can deny the application if the affiliate advertises on the site operators that violate U.S. law.

Please pay attention! In the case of New Jersey, the application for a license is submitted by the operator with whom the affiliate plans to cooperate.

Reporting obligations

As such, an affiliate has no reporting obligations as an operator has. Nevertheless, the tax obligations remain in effect and taxes must be paid in each state where the business is conducted, as well as federal tax. In terms of reducing the tax base, it makes sense to establish a company in the U.S. and link it with companies from a lower tax jurisdiction.

Subject to the requirements above, an affiliate may operate in the state and a foreign company (non-US) but we advise registering a company in the US, for ease of doing business and obtaining licenses/authorizations.

License fees by state

When obtaining a license, the applicant must pay the state fee.

A number of states require repeated payment of the state fee (annually, every 5 years, etc.).

Main tax rates

| Country | Income tax | VAT | Income tax on individuals | |

| Estonia | 0% (20% on distributed capital) | 20% (0% on export) | 20% | |

| Cyprus | 12.5% (special IP-Box mode allows to receive deductions and reduce the rate to 2.5-5%) | 19% (0% on export) | 0% (income up to 19 500 EUR per year) 20% (19 501- 28 000 EUR) 25% (28 001 -36 300 EUR) 30% (36,301-60,000 EUR) 35% (over 60,000 EUR) | |

| United Kingdom | 19% | 20% (0% on export) | 0% (income up to 12,570 GBP) 20% (income 12 571- 50 270 GBP) 40% (income 50 271 – 150 000 GBP) 45% (income from 150 001 GBP) |

Leave a request and our lawyers will contact you!

Found an inaccuracy? Let us know